Investing in silver is a popular strategy for those looking to diversify their portfolios and earn a good return on their investment. As a leading producer of silver, Australia offers investors numerous benefits, including access to a consistent supply of high-quality silver, a favorable economic environment, and world-class storage facilities. In addition, the strong legal framework in Australia provides peace of mind for investors, and the diversification benefits of silver can help reduce overall portfolio volatility.

If you’re considering investing in silver, it’s essential to consider all relevant factors, including market demand and supply, economic and political conditions, currency fluctuations, silver quality and purity, and more. Taking these factors into account, you can make an informed decision and potentially enjoy a profitable return on your investment when you buy silver in Australia.

Also Read: blooket/play

Market demand and supply

The supply and demand of silver can determine the price of silver in the market. If the demand for silver is high and the supply is low, the cost of silver will likely increase. Conversely, if the demand is low and the supply is high, the price of silver may decrease. So, it is critical to keep an eye on the demand and supply of silver in the market when considering investing.

Economic and political factors

In Australia, like in many countries, economic and political factors can significantly impact the price of silver. Inflation, interest rates, and political stability are all vital factors that can affect the value of silver. For instance, during periods of high inflation in Australia, investors may turn to silver as a hedge against inflation, causing the demand for silver to increase and drive its price. Additionally, political stability in Australia can also impact the price of silver. In times of political uncertainty, demand for silver as a safe-haven investment can rise, causing its price to increase. It is because silver is seen as a more stable and secure investment than other options in times of political turmoil.

The role of the Australian dollar

The value of the Australian dollar can significantly impact the price of silver in the country. The Australian dollar is a currency that is widely used in international trade, and changes in its value can affect the price of silver by making it more or less expensive for Australian investors to purchase silver from overseas markets.

For example, if the value of the Australian dollar increases relative to other currencies, it becomes more expensive for Australian investors to purchase silver in international markets. This, in turn, can cause the price of silver in Australia to decrease. Therefore, it’s crucial for those considering investing in silver in Australia to pay close attention to the value of the Australian dollar.

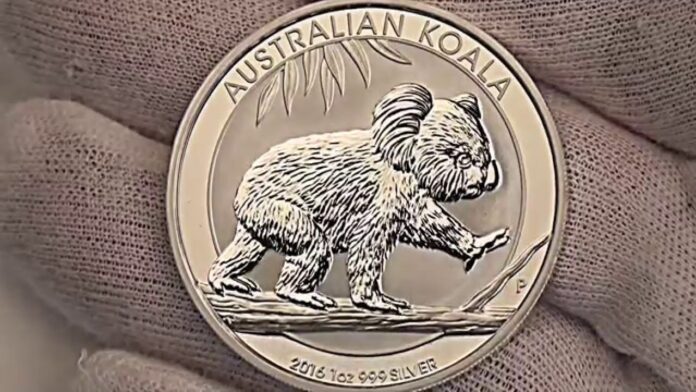

Quality and purity of the silver

Another important factor to consider when you buy silver in Australia is the quality and purity of the silver. Different types of silver products may have different levels of purity, and the purity of the silver can affect its value. For example, pure silver is generally more valuable than not pure silver. So, it is important to research and ensure that you invest in high-quality silver.

In conclusion, one should consider several key factors before investing in silver in Australia. These include economic and political factors such as inflation, interest rates, political stability, and the role of the Australian dollar. Understanding how these factors impact the price of silver can help you make more informed investment decisions. By taking the time to research and analyze these factors, you can better position yourself to reap the potential benefits of investing in silver in Australia.

Also Read: https://theventurebeat.com/